is an inheritance taxable in michigan

Although Michigan does not impose a separate inheritance or estate ta x on heirs you may have to pay state taxes on your annuity income. Michigan Estate Tax.

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Whether youll pay inheritance tax and.

. In 2021 federal estate tax generally. The inheritance tax is only levied by the state where it is relevant. A copy of all inheritance tax orders on file with the Probate Court.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Inheritance tax is levied by state law on an heirs right to receive property from an estate.

However if the inheritance is considered income in respect of a decedent youll be subject to some taxes. MI HAD an inheritance tax for estates of decedents who passed away prior to 10193. This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is.

Generally no you usually dont include your inheritance in your taxable income. Michigan Inheritance Tax and Gift Tax. An inheritance tax is a levy.

Where do I mail the information related to Michigan Inheritance Tax. What is Michigan tax on an inherited IRA. Mom recently passed and left an IRA with me listed as beneficiary.

Michigan Department of Treasury. Michigans estate tax is not operative as a result of changes in federal law. The estate tax is a tax on a persons assets after death.

There is no federal inheritance tax but there is a federal estate tax. Like the majority of states Michigan does. That tax is applied to a persons heirs after they have already received their inheritance.

There is no federal inheritance tax but there is a federal estate tax. View a list of items included in Michigan taxable income. Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today.

Taxable income is all income subject to Michigan individual income tax. Only a handful of states still impose inheritance taxes. This list serves as a guide and is not intended to replace.

An inheritance tax return must be filed for the estates of any person who died before October 1 1993. Generally speaking your inheritance is or could be taxableHowever the full story is more complicated than a simple yes or no answer. There is only one thing you need to know about Michigan estate taxes on an inheritanceAs of December 31 2004 there is no death or estate tax for.

Is the Inheritance I Received Taxable. The State of Michigan does not. I will be splitting it with my sisters.

A Federal Estate Tax return is required to be filed if the fair market value of the. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Michigan Taxes on Annuities.

Mom had opted to have. The estate tax is a tax on a persons assets after death.

Michigan Inheritance Tax Explained Rochester Law Center

Estate Planning Michigan Step By Step Guide To Estate Plannings

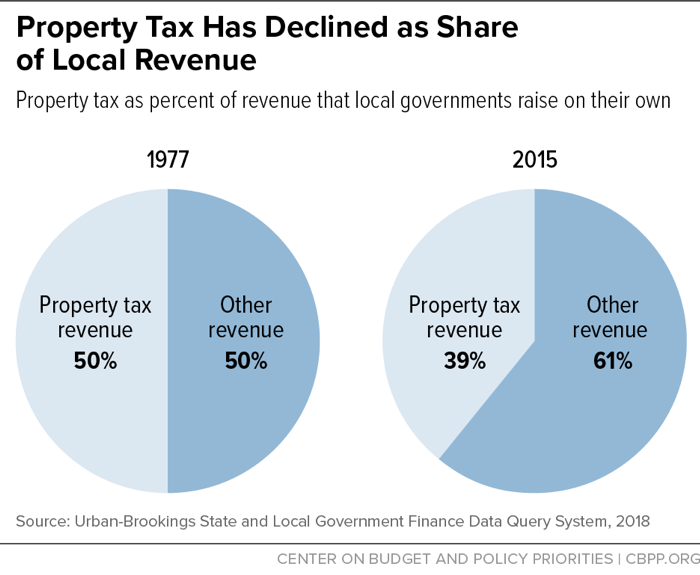

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

The Laws Of The State Of Michigan Relating To The Descent And Distribution Of Property With Digest Of The Inheritance Tax Law Michigan Trust Company Grand Rapids Mi Amazon Sg Books

Death And Taxes Nebraska S Inheritance Tax

Michigan Inheritance Tax Explained Rochester Law Center

Estate And Inheritance Taxes Around The World Tax Foundation

Estate Inheritance And Gift Taxes In Connecticut And Other States

Inheritance Tax Here S Who Pays And In Which States Bankrate

What Taxes Are Associated With An Inheritance Rhoades Mckee

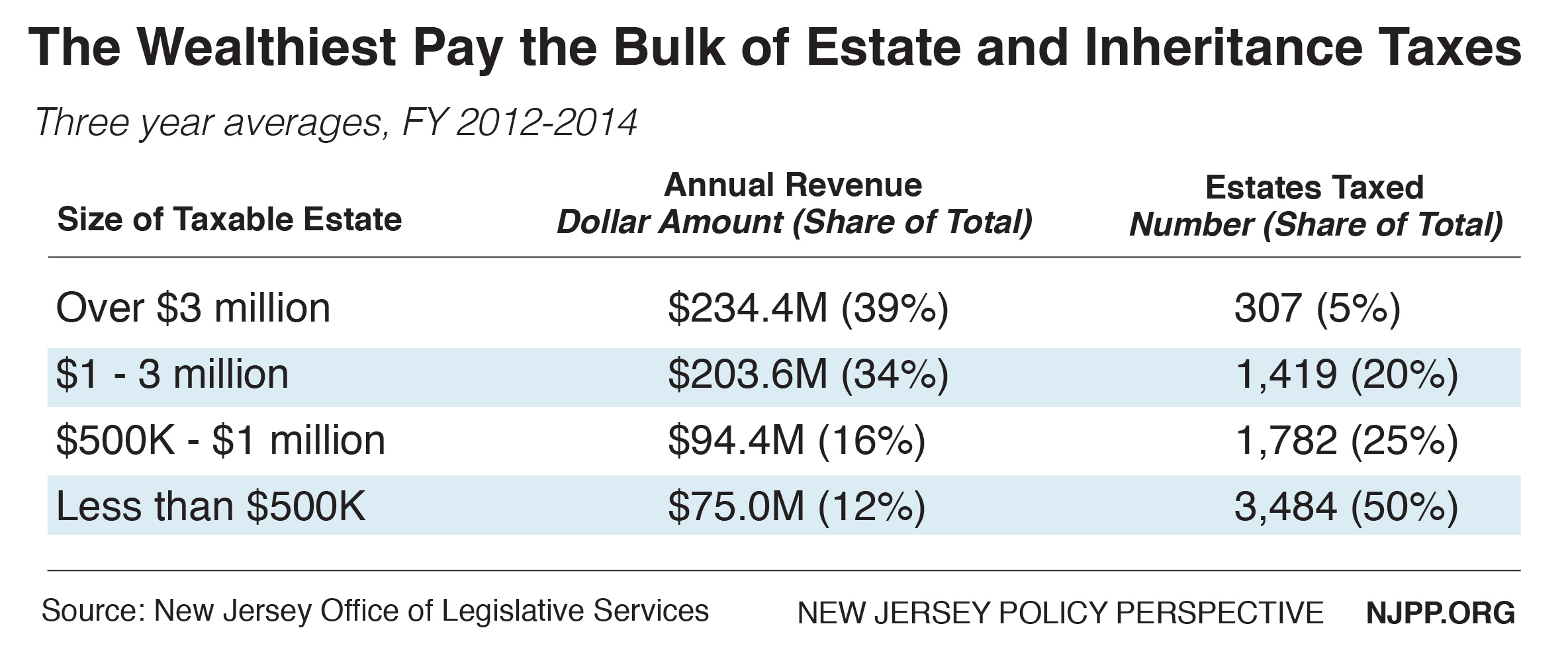

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Where Not To Die In 2022 The Greediest Death Tax States

Michigan Inheritance Tax Explained Rochester Law Center

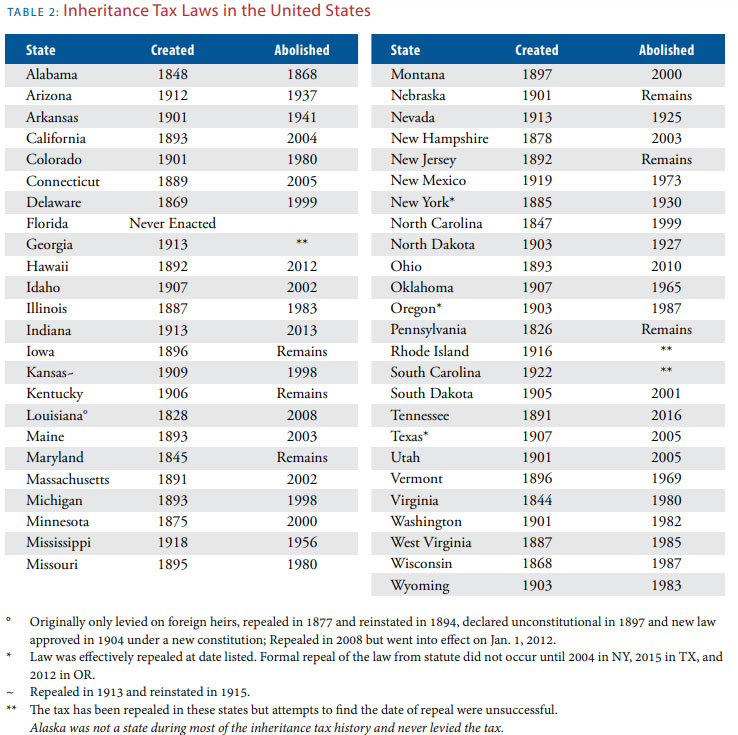

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Buy The Laws Of The State Of Michigan Relating To The Descent And Distribution Of Property With Digest Of The Inheritance Tax Law Book Online At Low Prices In India The

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate And Inheritance Taxes In The Wolverine State Sarah S Law Firm