can i gift more than the annual exclusion

The annual gift exclusion limit applies on a per-recipient basis. For 2022 the annual gift exclusion is 16000.

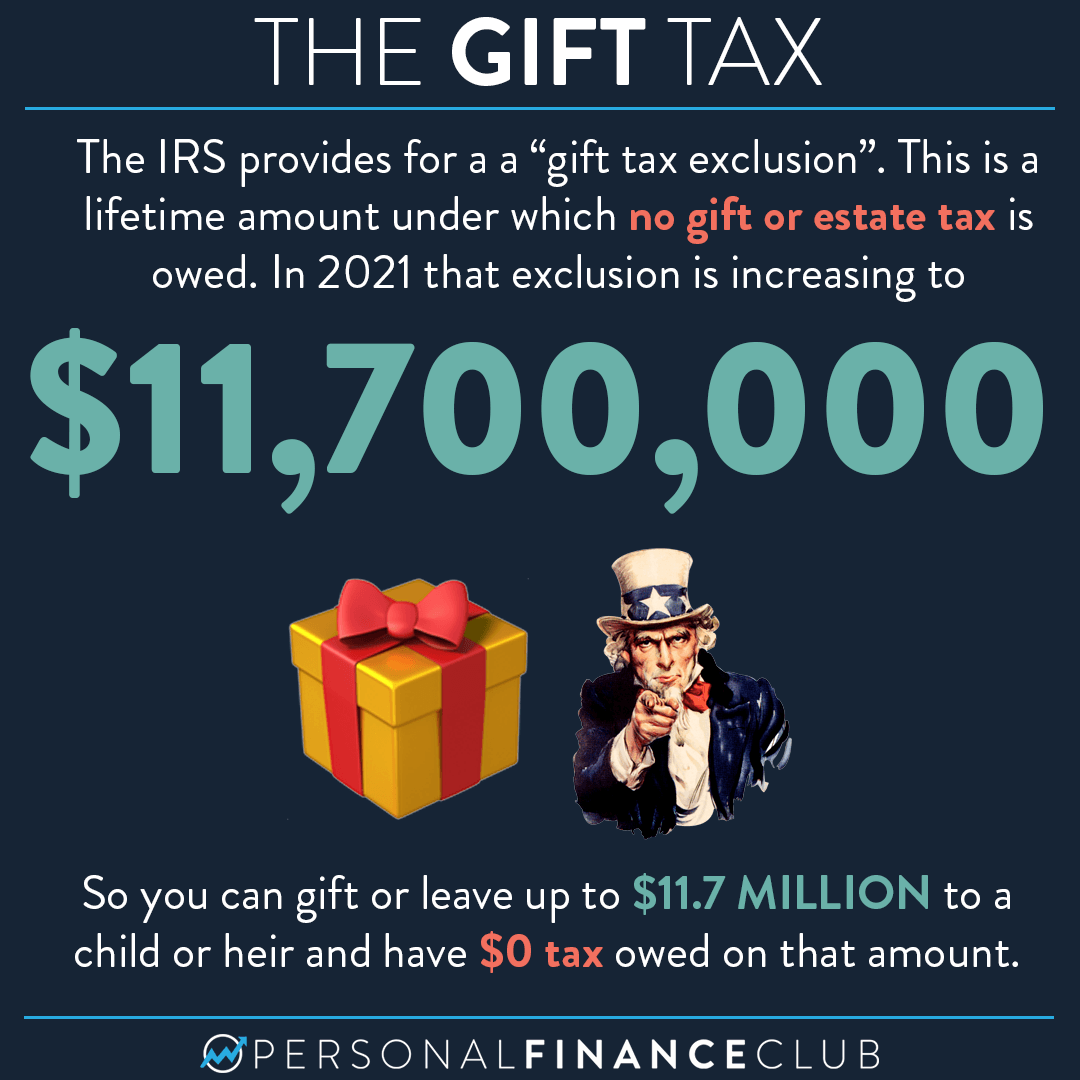

How Does The Gift Tax Work Personal Finance Club

This gift tax limit isnt a cap on the total sum of all your gifts for the year.

. If you are able and interested in giving more than 15k in a particular year there are several facets of the gift tax rule that may help. Vermont 11700000 lifetime exclusion amount. Well I think that you have to think about - each of us can make a gift of 15000 a year to someone and thats something called the annual exclusion gift tax exclusion.

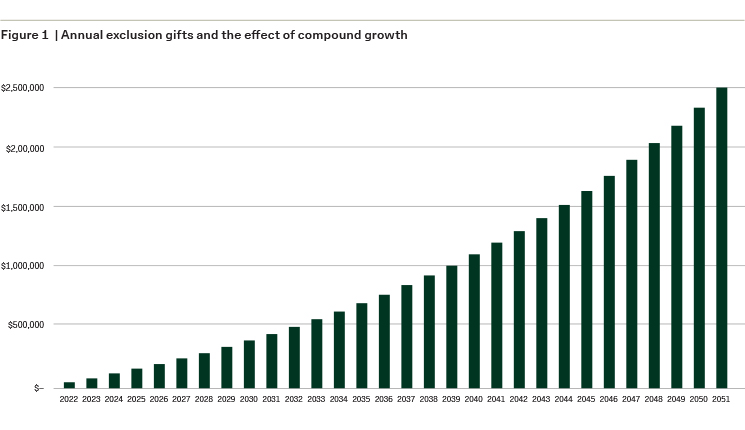

The annual exclusion can also be leveraged to give away more than 13000 of actual economic value to each recipient free of estate or gift taxes. However the annual exclusion is available only. Funding the SLAT Such gifts are excluded from gift tax only if they are gifts with present interest meaning that the recipient has the current enjoyment of the gift.

You can make individual 16000 gifts. The most important exception however is the Annual Gift Exclusion. You may also find additional information in.

Frequently Asked Questions on Gift Taxes Below are some of the more common questions and answers about Gift Tax issues. In order for a gift in trust to qualify for the gstt annual exclusion the trust must be for a grandchild or more remote descendant and must have the following terms. First the 15k limit applies to gifting from.

The annual gift tax exclusion is 15000 as of 2021. November 17 2022. If youve got four.

Under current law the exemption effectively shelters 10 million from tax indexed for inflation. Because more than 15000 is being transferred by a spouse a gift tax return or returns will have to be filed even if the 30000 exclusion covers total gifts. It can shelter from tax gifts above the annual gift tax exclusion.

Annual exclusion of 16750 for 2021 and 2022. How the lifetime gift tax exclusion works. Two parents give 30000 to each of their children in 2018 15000 annual exclusion 2 gift-givers 30000 per recipient.

If you give your child some stocks worth 7500 and you make a 10000 contribution to a 529 plan account for that child. You can gift to as many people as you want. And because its per.

If you want to keep your tax financial life simple you. The 16000 annual gift exclusion is a limit on nontaxable gifts per person and you can give multiple people up to 16000 each without incurring any tax liability. The annual gift tax exemption allows taxpayers to give certain gifts without using the lifetime exemption amount.

By making maximum use of the annual gift tax exclusion you can pass substantial amounts of assets to loved ones during your lifetime without any gift tax. There are certain gifting strategies that can allow you to gift more than this amount. As we mentioned above the limit of 15000 applies on a per-recipient basis.

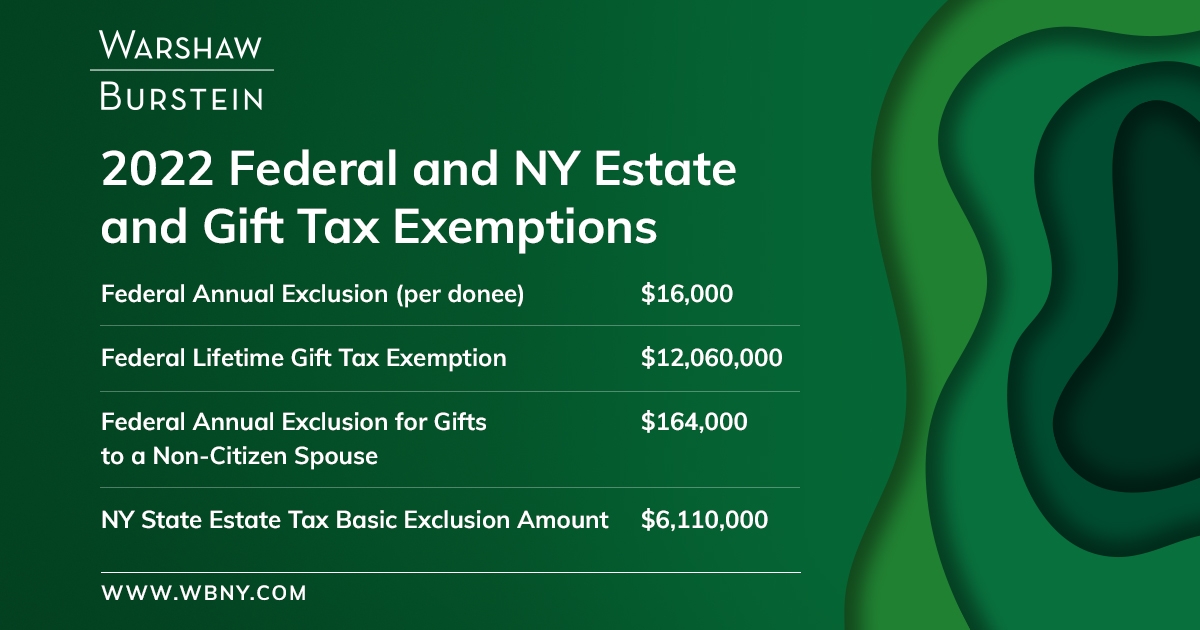

Spouses may elect to split a gift to a child or other donee so that each spouse is deemed to have made one-half of the gift even if one spouse wrote the check. In 2022 the annual gift tax exemption is increased to 16000 per. However the amounts of.

Year-End Gifts and the Gift Tax Annual Exclusion. 2503 an annual exclusion is allowed for taxable gifts the amount of which as adjusted for inflation was 12000 in 2007. This exclusion makes gifts that do not exceed the annual exclusion amount for that calendar.

Consider the impact of your other gifts during the year. On top of the 16000 annual exclusion in 2022 you get a 1209 million lifetime exclusion in 2022. By using your annual exclusion those gifts within generous limits can reduce the size of your taxable estate.

Gifts In Excess Of The Annual Exclusion Grim Law

:max_bytes(150000):strip_icc()/money-for-you-172411636-fbc9ab4f707a49c08e17bc07f45f3f1d.jpg)

Gift Tax Explained What It Is And How Much You Can Gift Tax Free

Irs Announces Higher Estate And Gift Tax Limits For 2020

:max_bytes(150000):strip_icc()/GettyImages-83403958-56c523523df78c763fa19039.jpg)

Gifts That Are Subject To The Federal Gift Tax

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Tax Implications Of Supporting Adult Children Taxact Blog

The Estate Tax And Lifetime Gifting Charles Schwab

Gift Tax Limits For 2022 Annual And Lifetime Magnifymoney

How Much Can I Gift To My Children Annually Without Paying Federal Gift Tax

Annual Gift Tax Exclusions First Republic Bank

Annual Gift Tax Exclusion A Complete Guide To Gifting

Annual Gift Tax Exclusion A Complete Guide To Gifting

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

Wealth Transfer And The Gift Tax Exclusion Aspiriant

Warshaw Burstein Llp 2022 Trust And Estates Updates

Gift Tax Limit 2022 How Much Can You Gift Smartasset

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free